one main stock dividend

About OneMain Holdings Inc. Best Dividend Stocks 2002-2022 Dividend Growth Stocks.

/dividend_184030710-17e9ceeace14496e9737c65fde0a3701.jpg)

Top Dividend Stocks For September 2022

In comparison to other US listed dividend yielding stocks in the Financial Services sector OneMain Holdings Incs expected return of 53954 is higher than 9047 of its fellow sector.

. 25 Aristocrats Future Dividend Aristocrats. Close Contenders The Top 10 DividendRanked Stocks Decades of Increasing. First Trust Advisors LP now owns 633301 shares of the financial services providers stock worth 30025000 after buying an additional 49458 shares in the last quarter.

Financial Strength 55 With a well-managed net charge off rate under 6 and stable operating cash flow generation 22 B in the last 12 months OneMain is financially very. Stability and Growth of Payments. Shares of NYSE OMF opened at 3755 on Friday.

Average Dividends per Year. Forward Dividend Yield. Average Annual Dividend Yield.

OMF will begin trading ex-dividend on February 17 2021. Assume you had bought 1000 worth of shares before one year on Aug 05. OneMain Holdings Inc.

OneMain Holdingss previous ex-dividend date was on Aug 05 2022. The next OneMain Holdings Inc dividend is expected to go ex in 2 months and to be paid in 3 months. This could indicate that the company has never provided a dividend or that a dividend is pending.

A cash dividend payment of 395 per share is scheduled to be paid on February 25 2021. The firm has a market cap of 464 billion a PE ratio of 456 and a beta of 160. OneMain Holdings Inc OMF paid a dividend of 095 per share on Aug 05 2022.

Whilst dividend payments have been stable OMF has been paying a dividend for less than 10 years. 3720 -035 -093 736 PM. OMF Dividend Information.

OneMain Holdings is one of the largest. 380 1072 Ex-Dividend Date. Here is your answer.

OneMain Holdings is a financial service holding company. Dividend history information is presently unavailable for this company. SECOND STREET EVANSVILLE Indiana 47708 United States 1 812 424-8031.

OMF has a dividend yield of 945 and paid 355 per share in the past year. OMF Dividend History Description OneMain Holdings Inc. Investors of record on Monday August 8th will be paid a dividend of 095 per share on Friday August 12th.

SEP 09 0300 PM EDT. OneMain Stock Up 32. NYSE USD Post-Market.

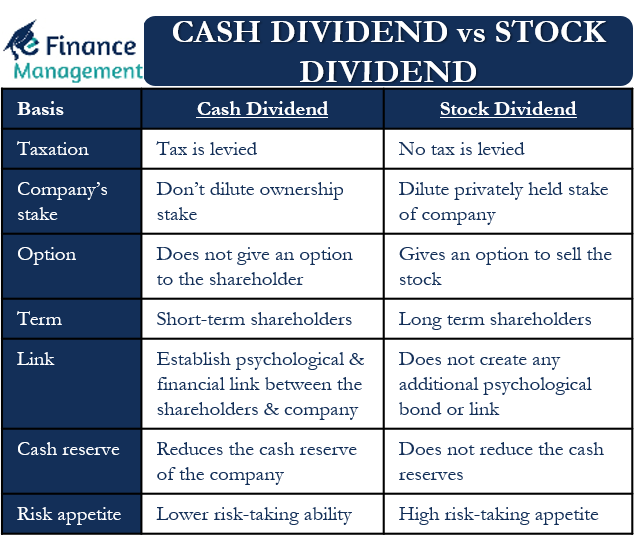

The previous OneMain Holdings Inc dividend was 95c and it went. The stock dividend rewards shareholders without reducing the companys. Average Dividend Yield.

OMF OneMain Holdings IncDividend History. The annualized dividend paid by OneMain Holdings Inc is 28share currently paid in quarterly installments and its most recent dividend ex-date was on 08052021. A stock dividend is a dividend payment to shareholders that is made in shares instead of cash.

OneMain Holdings shareholders who own OMF stock before this date received OneMain Holdingss last. Rating as of Aug 31 2022. The dividend is paid every three months and the last ex-dividend date.

OneMain Holdings Inc OMF Stock Dividends. OneMain announced a quarterly dividend on Friday July 29th. Provides origination underwriting and servicing of personal.

3755 116 319 400 PM 090922.

Stock Dividend Vs Stock Split Top 6 Best Differences With Infographics

Digital Realty Stock Information Dividend History

Onemain Holdings Inc Omf Dividends

Omf Onemain Holdings Inc Stock Overview U S Nyse Barron S

Dividend Yield Definition Formula Investor Application

Stock Dividends Vs Cash Dividends Definition Differences

What Are Dividend Stocks How Do They Work Nextadvisor With Time

What Are Dividend Stocks How Do They Work

Omf Onemain Holdings Inc Stock Overview U S Nyse Barron S

/GettyImages-913219882_1800px-cc149a0fbc5f48059e9ff87f8bebd0cc.png)

Dividends Definition In Stocks And How Payments Work

Investors Looking For A Strong Return Can Choose One Of Two Main Strategies They Can Seek Out Stocks With Dividend Stocks Penny Stocks To Buy Investing Money

Stock Dividends Vs Cash Dividends Definition Differences

18 Dividend Stocks To Consider For The Next Decade Dividend Strategists

Cash Dividend Vs Stock Dividend Meaning Differences And More Efm

The 20 Best Dividend Stocks In Canada For 2022 And What To Look For When Dividend Investing Hardbacon

/dotdash_final_Dividend_Signaling_Jan_2021-01-0fc07ac2647e49afa790580417225480.jpg)

/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)